The Problem with Token Wrapping

Apr 10, 2023

Token bridges allow users to move value from one blockchain to another. While this sounds simple, most bridges are difficult to use and often cause problems that impact other areas of the blockchains they connect.

Bridges often employ something called token wrapping to move assets between chains. As an example, crypto users regularly need to move Bitcoin onto the Ethereum blockchain. Because the Ethereum chain doesn't natively support Bitcoin, users can get around this by "wrapping" their Bitcoin to make it compatible with the Ethereum network. This challenge isn't limited to just Bitcoin or Ethereum---it's present on almost every blockchain.

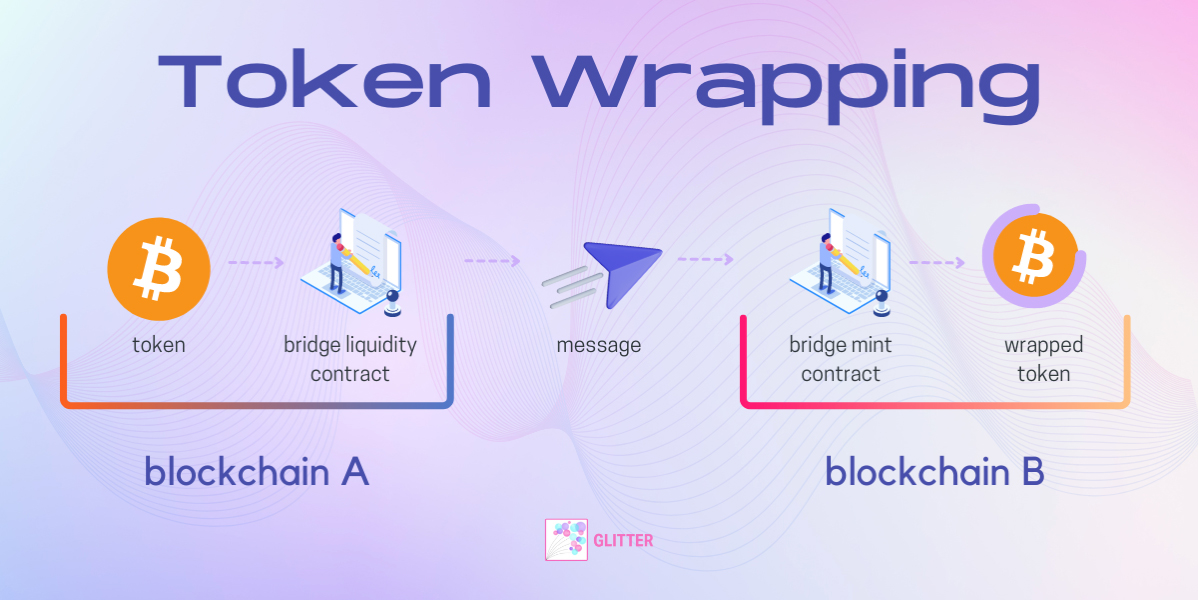

A token-wrapping bridge is a somewhat simple mechanism. If you want to move an asset from chain A to chain B, a bridge locks away your original asset on chain A and creates a new token that represents it on chain B.

This wrapped token can then be used for transactions on chain B while still being redeemable for the original asset on chain A at any time. It's like an IOU that lets you use a token on a non-native network while promising you the underlying asset on the home blockchain should you decide to redeem it.

Token wrapping is an innovative solution to a big challenge, but as we'll get into, comes with some major drawbacks. The ultimate goal for true blockchain interoperability is to minimise the presence of wrapped tokens and instead issue tokens natively on different networks.

Glitter Finance was built to address this challenge. In this article, we'll explore where wrapped tokens have been known to fail, what other bridges do that fall short of a complete solution, and how Glitter Finance stands apart as the ultimate interoperability solution.

What's Wrong with Token Wrapping?

Token wrapping was a clever innovation that solved the problem of token interoperability in the early days of web3. Unfortunately, token wrapping has several downsides that have been made worse by the proliferation of bridge protocols and the wrapped tokens each supports.

Depegging

Wrapped tokens are backed 1:1 by the original asset on the home chain. Both tokens can hold price parity thanks to people---or bots---known as arbitrageurs. If Token A is valued at $10 and the price of the wrapped version of Token A slips, savvy traders are incentivised to buy it at a discount and sell it on the home chain for a profit, which in turn, restores price parity. It's an elegantly simple idea that works extremely well---until it doesn't.

Depegging---when the price of the wrapped token falls significantly out of sync with the original---is a very real problem for bridges. In fact, some of the biggest bridges in the world have fallen victim to this exact issue.

Depegs typically happen in one of two ways. The most critical, and often irreparable, way it occurs is when the ratio of wrapped tokens to regular tokens gets thrown off balance, typically as a result of a hack.

Hackers can exploit a bridge via the mint function, allowing them to mint an infinite amount of the wrapped token without needing to provide an equivalent amount of the original token themselves. They then start using their tokens everywhere they can, and as there is no collateral on the other side of the bridge, the wrapped token price heads to zero as the hacker makes off with their profits.

Bankruns can also cause temporary depegs. Rumours---or less often, truths---around the security of a bridge, or even the original token, can lead to mass sell-offs. As token holders panic, they rush to sell their tokens en masse. Without sufficient liquidity to absorb this, the wrapped token's value naturally decreases. While this rarely leads to a permanent depeg as with minting exploits, this can have disastrous impacts on wrapped token users, primarily people using their wrapped tokens as loan collateral.

For example, if someone is using wrapped ETH to secure a loan, and its price temporarily drops because of a bank run, their collateral can be liquidated, even though the same loan with regular ETH on Ethereum would have remained safe.

In a perfect world, wrapped tokens should have an identical risk profile to their unwrapped counterparts. As we've illustrated, however, wrapping isn't a perfect solution and is inherently less safe to both hold and use.

Diminishing liquidity

Bridges work best when they're efficient for both large and small transfers. To do this, bridges often incentivise large liquidity pools to handle big transactions. If someone wants to bridge millions of dollars, there needs to be enough liquidity to make this possible.

At the peak of bull run euphoria, liquidity might not be a problem. But when things start to slow down and investors become more cautious, liquidity can start to dry up. This starts as investors de-risk their portfolios by moving their positions from lower-cap assets into more stable tokens on more established chains. As value moves in large amounts in a single direction, the liquidity at the destination swells, while the other side is left all but dry.

To illustrate this problem, let's think about a trader named Bob who bridges 100 ETH from Ethereum to blockchain X, receiving 100 wrapped ETH (wrETH). Bob goes on to invest his wrETH in some low-cap tokens and a couple of NFTs. Being the slick trader he is, their prices skyrocket and the total value of his holdings doubles to 200 ETH. Feeling like a genius, he heads to an exchange to convert his various tokens back into wrETH to move back to the Ethereum network to cash out.

Unfortunately for Bob, others have had the same idea and there's no longer enough liquidity in the bridge to support the transfer. Bob is now stuck on blockchain X with his various assets and has no way to move them off.

In some cases, token wrapping can also lead to liquidity fragmentation capable of harming the underlying asset. When all tokens are on a single blockchain, liquidity is normally not a problem. But as bridges come online and begin incentivising liquidity contributions, the situation can deteriorate quickly. Liquidity becomes locked in various pools with the value represented across several separate chains, leading to liquidity fragmentation that reduces the availability of an asset wherever it's being used.

As liquidity directly impacts price, this can cause the token's value to drop across the board, even on the native chain.

Honeypots

If you're a hacker, bridges make excellent targets. Because of the amount of value large bridges handle, wrapped token contracts become enticing honeypots for digital criminals.

When a bridge is operating correctly, every dollar of value in a wrapped token is backed by the same amount of value in the original asset locked in a smart contract. If a hacker can exploit the mint function and create wrapped tokens, as long as they're quick enough to move the tokens back across the bridge before the developers close the door, large fraudulent redemptions in the underlying asset are possible.

There are other ways attackers can exploit bridges to get away with their liquidity, but the motivation is the same in every case: wrapped token contracts entice attackers with the potential of massive paydays.

Alternative Bridges

The issues with token wrapping are well known by developers and several solutions have been proposed that approach bridging from different angles. While these approaches offer valid alternatives, only Glitter Finance offers a comprehensive solution that ticks all the boxes.

One of the most discussed alternatives is to create base interoperability layers that different bridge protocols can use. These are effectively blockchains that connect blockchains, allowing for greater security for the bridges that use their infrastructure. Aptos and BTC.B are some examples of bridges that use an interoperability layer for bridging, allowing them to bridge funds while increasing security.

The issue with these bridges is that they still rely on token wrapping and fail to address the problems that come with it. Even though there are fewer opportunities for attackers to exploit thanks to the increased security around the cross-chain messages, token depegs and liquidity issues still occur. Plus, with the large honeypots that come with token-wrapping contracts, sophisticated hackers will only continue hunting for new exploits.

The Glitter Finance Solution

Glitter Finance was created to solve the specific problems plaguing the cross-chain industry. By removing the reliance on wrapped tokens to move value from one chain to another, Glitter creates a safer, more stable way to bridge.

Instead of relying on a single base interoperability layer, Glitter has built several between the different chains it services. This means the protocol can keep the liquidity for different chains separate, reducing the size of any one pool and, in turn, reducing the payoff if an attacker should attempt an exploit.

One of Glitter's strongest innovations is to do away with token wrapping altogether. Glitter's USDC bridges don't rely on token wrapping to bridge and have no liquidity pools to exploit. Instead, requests are routed directly through Circle---one of the issuing parties of USDC---removing the honeypots entirely and ensuring that there will always be sufficient liquidity for swaps.

Rather than placing the different bridge features into different dApps like other bridges, Glitter combines all protocol services into a single, easy-to-use interface. Whether you're looking to move millions or simply port across a small amount of value, Glitter does it all in a few clicks.